The 6-Minute Rule for Financial

Wiki Article

The Only Guide for Financial Advisor

Table of ContentsThe smart Trick of 401(k) Rollovers That Nobody is Discussing401(k) Rollovers for DummiesThe Ultimate Guide To Planner

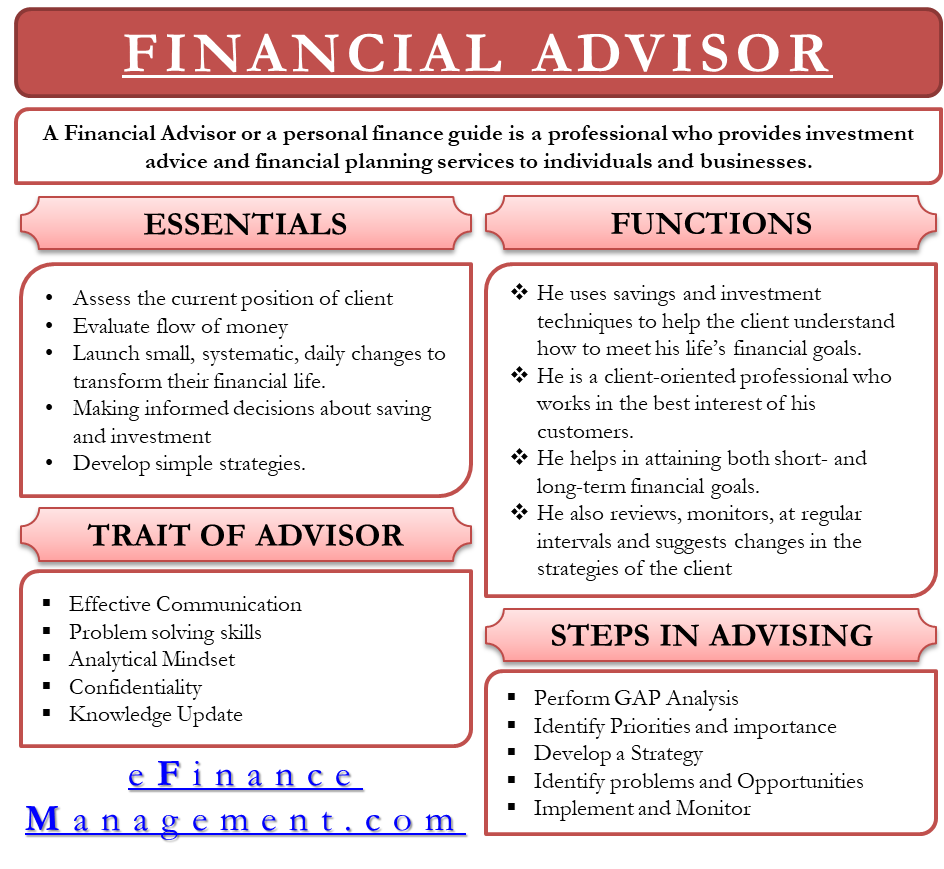

A monetary consultant acts as a trusted expert and guide, utilizing their expertise and knowledge of economic markets to develop individualized financial plans as well as techniques that meet each client's distinct needs as well as objectives. They work to assist their clients achieve a steady financial future and safety and security as well as aid them navigate complicated financial decisions as well as obstacles.

401(k) Rollovers - The Facts

A monetary consultant can aid you attend to and also handle any type of arrearages and establish a strategy to become debt-free. A financial consultant can assist you intend to distribute your possessions after your death, including producing a will and also establishing trust funds. A monetary consultant can aid you recognize as well as take care of the dangers related to your economic scenario and financial investments - Planner.

An economic expert can aid clients in making investment decisions in numerous ways: Financial advisors will deal with clients to recognize their danger tolerance and also create an individualized investment approach that lines up with their objectives as well as comfort degree. Advisors commonly recommend a diversified profile of financial investments, including supplies, bonds, as well as various other assets, to aid mitigate danger and maximize prospective returns.

Financial consultants have substantial understanding as well as competence in the economic markets, and also they can aid customers understand the prospective benefits and also dangers linked with various financial investment alternatives. Financial consultants will routinely assess clients' profiles and also make suggestions for changes to guarantee they stay straightened with customers' objectives and also the present market problems (Traditional).

Not known Facts About 401(k) Rollovers

Yes, a financial advisor can aid with financial debt monitoring. Financial obligation administration is necessary to total financial planning, as well as financial experts can give guidance and also support around. An economic consultant can assist customers understand their debt situation, examine their present financial obligations, and create a financial obligation management plan. This might include establishing approaches for settling high-interest debt, consolidating financial debt, and also developing a spending plan to handle future investing.

These designations suggest that the expert has completed extensive training and passed examinations in financial planning, financial investment administration, and various other appropriate areas. Seek financial experts with a number of years experience in the economic solutions market. Advisors that have remained in the area for a long period of time are likely to have a much deeper understanding of the financial markets and also financial investment approaches and also might be better outfitted to deal with complicated economic situations.Ask the economic consultant for referrals from present or past customers. Financial advisors commonly get paid in among numerous means: Some economic consultants make a commission for selling monetary items, such as common funds, insurance products, click over here or annuities. In these situations, the consultant makes a percentage of the product's price. Various other economic consultants work with a fee-based design, charging a charge for their recommendations and solutions. Some financial consultants function for banks, such as financial institutions or brokerage firms, as well as are paid a wage. In summary, monetary experts get paid on a payment, fee-based, as well as income. Below are means to discover a trusted financial consultant: Ask friends, family members, or coworkers for references to monetary experts they trust as well as have dealt with. As soon as you have a listing of potential consultants, research study their backgrounds as well as qualifications. Inspect if they have any type of disciplinary history or complaints with regulative agencies, such as the Financial Industry Regulatory Authority (FINRA) or the Stocks and also Exchange Compensation (SEC). Arrange a meeting or consultation with each expert to review your financial goals and also to ask questions regarding their experience, investment approach, and also payment design. Verify that the economic consultant has the ideal licenses and also certifications, such as a Licensed Financial Planner(CFP)classification or a Series 7 license. Select an advisor you really feel comfy with as well as depend on to handle your financial resources. It's vital to discover an advisor that listens to your needs, understands your financial scenario, as well as has a tried and tested performance history helpful clients attain their monetary goals. Nonetheless, dealing with a monetary advisor can be highly advantageous for some people, as they can provide valuable competence, guidance, and support in taking care of funds and also making investment choices. Additionally, an economic expert can assist create a thorough economic plan, make suggestions for financial investments as well as run the risk of management, as well as offer recurring support as well as monitoring to aid make sure clients reach their monetary goals. In enhancement, some people may favor to do their study and make their own investment choices, and for these people , paying a financial expert might not be essential. A licensed investment consultant(RIA )is a professional that gives investment advice and also manages client portfolios. They are signed up with the Stocks as well as Exchange Commission (SEC )or a state protections regulatory authority. This can consist of budgeting, debt management, insurance plans, as well as investment schemes all to boost their customers'total wealth.

Report this wiki page